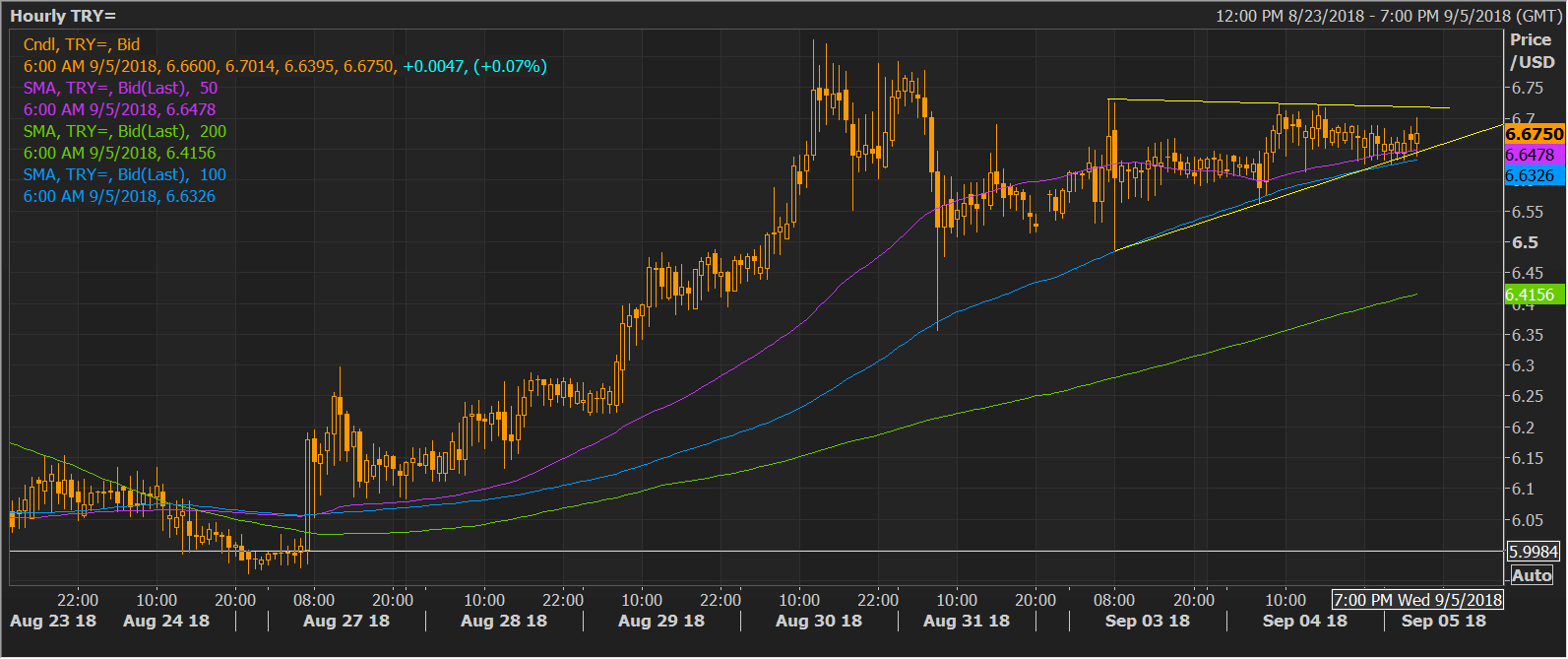

USD/TRY Technical Analysis: ascending triangle on 1H chart

- The USD/TRY pair has charted an ascending triangle, a bullish pattern, on the hourly chart.

- The short-term moving averages (MAs), 5-day, 10-day, are trending north, indicating a bullish setup and the hourly relative strength index (RSI) has also adopted a bullish bias.

- A break above the top end of the triangle would strengthen the bull grip and allow a rally to 6.8354 (Aug. 30 high) - record highs above 7.00.

- A downside break of the triangle would signal the pullback from the record highs above 7.00 has resumed and could yield a drop to 6.5.

Hourly Chart

Spot Rate: 6.86

Daily High: 6.6992

Daily Low: 6.6416

Trend: Bullish

Resistance

R1: 6.8354 (Aug. 30 high)

R2: 7.00 (psychological hurdle)

R3: 7.08 (record high)

Support

S1: 6.63 (50-hour moving average)

S2: 6.57 (previous day's low)

S3: 6.51 (Sep. 3 low support on the hourly chart)

start Trading with Free $30 : CLAIM NOW $30

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

SUPPORT , CLICK SMS BAR ABOVE THEN TALK TO US.

Comments

Post a Comment